Dan Reiter, CFP®, CPA, CVGA, CExP

Selling your business will likely be the single largest financial event of your life. However, you can limit an abundant amount of stress with confidence in the fact that you are selling for at least the amount you need to walk away from the business.

One of the first exercises we complete with new business owner clients is to define the minimum amount they need from the company to support their lifestyle and goals after they exit.

Once we understand the minimum amount the business owner needs, we complete a current valuation of the business to determine a baseline of what the company is worth.

Finally, with those two numbers, we can determine if there is a gap between what the business is worth today and what it needs to sell for so the owner can reach their goals.

To answer the question of how much a small business owner needs to sell for, we consider three important questions, among others:

-

What does your lifestyle look like today?

-

What is your planned exit path?

-

What comes next?

What Does Your Lifestyle Look Like Today?

Quantifying your lifestyle today is one of the most critical steps in determining how much you need from your business when you are ready to sell. Many individuals tend to underestimate the amount they spend regularly. If a financial plan is built on incorrect spending needs, it may result in significantly miscalculating how much you need to sell for.

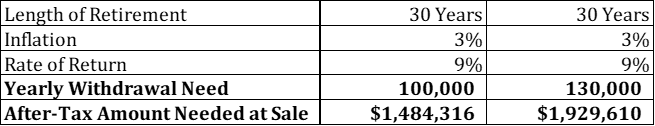

As an example, see the following:

If you assume that your need from the portfolio is $100,000—but you later realize you forgot to include a few things and it’s closer to $130,000/year—your necessary sale price just went up by about $445,000. If you also factor in taxes from the sale of the business, in this example, it could mean a difference in the sale price of 30-40%!

Working with a professional advisor with experience in accurately quantifying lifestyle and current spending may be an invaluable step in getting this number right. Making sure all current expenses and goals are accounted for before you start the process of selling may prevent a realization that you did not sell for enough—a realization that usually comes too late.

What Is Your Planned Exit Path?

The next important factor to consider is your desired exit path. Do you have plans to transition the business to a family member or employee? To a third-party strategic buyer? To an employee stock ownership plan (ESOP)? Maintain ownership long-term and transition at your passing?

Each of these has different considerations for the amount and structure of the eventual sale or transfer.

Transfers to insiders, such as key employees or family members, typically require a significant amount of advanced planning. The single largest reason is because of one fact—they usually cannot afford to cut the check! This fact does not necessarily mean that a transfer isn’t viable; it just means that preparation is critical to make it successful.

Typically, not only does an internal transfer affect the potential sale price (strategic third-party buyers will almost always pay more, for example), but the structure of the transaction is also impacted. It is not uncommon to receive the proceeds of an internal sale over many years, for instance, rather than up-front.

If you must wait several years to receive the funds, that also means you may not immediately benefit from the resulting growth of reinvesting those dollars after you sell. Ultimately, this may result in an impact on your own long-term financial plan that must be considered.

Similarly, if you sell to a third-party strategic or financial buyer, you may have to contend with an earnout as part of the transaction. An earnout is where the buyer requires that an amount of the sale or listing price is held back until certain criteria are met—often a financial result or certain passage of time.

In this case, you will also have to consider that the timing of the funds being received will not be up-front, if at all. You should carefully weigh the risks before including an earnout as a resource in your financial plan.

Also, if you work with a business broker, don’t forget to include the cost of their commission! For small businesses, this cost may be upward of 10-15% of the sale price.

In summary, if you sell to insiders or a third party with a substantial earnout, you may need to ensure that you have accumulated enough outside of the business before the sale to compensate for a potentially lower sale price.

What Comes Next?

Considering what your life will look like after your exit is perhaps the most important element of defining the amount you need from a sale.

Many business owners spend at least 60 hours per week running their business, or the equivalent of 3,000 hours per year. If this is you, think to yourself: How do you plan on spending this time? Playing a round of golf four days per week? Considering some cold weather months—at least here in Kansas City, MO—this probably takes about 500 hours. What about the remaining 2,500?

I’m guessing you see the point. Answers to these questions may result in a significant change to what financial resources will be required. We often discover that owners spend significantly more money once they exit their business because they have more time and flexibility to spend it!

If you plan just to maintain your current spending and lifestyle into retirement, you may find that it is not enough.

Finally, you should also consider your legacy or charitable goals. Is it your desire to leave a certain amount of money to children or other family members once you are gone? To support certain charitable organizations? Invest in a new business?

All these goals should be quantified and included as part of the necessary sale price of your business before you sign the sale agreement. Otherwise, you might discover, too late, that the sale price of your business wasn’t enough to meet all your objectives.

In summary, quantifying the amount you need from your business can be a complex process that also includes certain assumptions about your life expectancy, investment growth rates, future inflation, and other important factors.

It is highly recommended that you work with an experienced, professional financial advisor who has the knowledge and experience in working with business owners to make sure you leave no stone unturned.

Ready to get Started?

Schedule a call with one of our Certified Financial Planner™ (CFP®) professionals today!